How To Find Houses In Foreclosure To Buy (FAST & FREE)

Sep 05, 2025

Today, let's break down exactly how to find houses in foreclosure to buy. These are strategies that work in any market, cost you nothing to use, and can lead to serious profits.

These are the same methods I used to become a multimillionaire before the age of 30, build a $10 million real estate portfolio, and consistently generate over $400,000 a year in passive income.

I’ll also walk you through how to analyze a foreclosure using my personal deal calculator. This is the same tool I use to analyze every single investment, and you can download it completely free.

Whether you're wholesaling, fixing and flipping, or buying rental properties, this guide will show you how to find better real estate deals, avoid costly mistakes, and earn more money on every foreclosure you buy.

- What is a Foreclosure?

- Finding Deals on HUD Home Store

- HomePath: Fannie Mae Foreclosures Explained

- Using Zillow to Find Foreclosures

- How To Find REO Properties: What to Look For

- Realtor.com Foreclosures and Deal Evaluation

- Using Redfin to Find Foreclosed Properties

- Understanding the Foreclosure Timeline

- Analyzing Actual Foreclosure Listings

- Analyzing a Foreclosure with Our Deal Calculator

- Running Rental Numbers on a Foreclosure

- Rental Cash Flow Analysis Breakdown

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

What is a Foreclosure?

A foreclosure is kind of like a breakup—except instead of ghosting your ex, you ghost your bank, and they always show up to take their stuff back.

More seriously, foreclosure means the owner stopped paying their mortgage, so the bank stepped in to sell the property, often at a discount.

That’s where savvy investors can find great deals.

Finding Deals on HUD Home Store

The first place I like to look for foreclosed home deals, especially undervalued ones, is HUDHomeStore.gov.

HUD stands for U.S. Department of Housing and Urban Development. A HUD home is a foreclosed property that was originally purchased with an FHA loan. When the borrower defaults, HUD takes back the property and attempts to resell it.

These are government-owned homes, not bank-owned REOs. They’re listed directly on the official HUD website and not always on Zillow or Redfin. To place an offer, you’ll need a HUD-approved real estate agent.

On the homepage, you’ll see a U.S. map with listings nationwide. For example, California has only 61 HUD properties for sale, Nevada has 6, and Texas has 142. This shows there isn’t a huge amount of HUD inventory on the market.

HUD also offers special programs, such as the Good Neighbor Next Door program, which provides a 50% discount to law enforcement officers, firefighters, EMTs, and teachers. However, inventory is limited—only a handful of properties are available nationwide.

There’s also a HUD nonprofit program, allowing nonprofits to purchase discounted homes, and a Dollar Homes initiative where certain government agencies can acquire properties for $1. These are usually restricted for affordable housing programs, not for investors.

Exploring HUD Listings and Filters

Let’s take Alabama as an example. There are 50 HUD properties listed, and investors are actively buying there for both flips and rentals.

You can filter results by price, bedrooms, bathrooms, listing period, and bid date. When properties are first listed, they’re typically only available to owner-occupants for the first two to four weeks. If they don’t sell, they open up to investors.

HUD homes also include Property Condition Reports, almost like a mini inspection. You’ll find details on major systems like HVAC and plumbing, which is rare compared to most foreclosure listings.

Some homes are eligible for FHA’s $100 down program or 203k rehab loan, allowing buyers to finance renovations directly into their mortgage.

Read Also: Wholesaling Hud Homes: (Ultimate) Guide

HUD Programs and Owner Occupant Advantages

One of the best incentives for HUD homes is the $100 Down Payment Program, which allows owner-occupants to purchase with almost no money down.

Owner-occupants also benefit from the exclusive listing period, which prevents investors from scooping up all the best deals immediately.

HUD listings often include direct asset manager and broker contact info, making it easy to ask questions or get details.

HomePath: Fannie Mae Foreclosures Explained

Another great site for finding foreclosure deals is HomePath.com, which is the official platform for Fannie Mae-owned properties.

These homes were foreclosed on conventional loans (not FHA like HUD homes). They’re bank-owned but managed directly by Fannie Mae instead of third-party brokers.

Personally, my first major rehab project came from a HomePath foreclosure in Cleveland back in 2016. I bought a triplex for $69,000, invested $50,000 into rehab, and eventually sold it for $295,000—making a $170,000 profit.

HomePath properties are often listed below market value because Fannie Mae wants to unload them quickly. They can usually be purchased with conventional financing, which is a huge advantage.

They also offer programs like the Ready Buyer Program (up to 3% in closing cost assistance for first-time buyers) and the First Look Program (giving owner-occupants priority access before investors).

The trade-off? Homes are sold strictly “as-is,” and inventory varies depending on your market.

Using Zillow to Find Foreclosures

Zillow has a foreclosure filter that allows you to see bank-owned homes, auctions, and pre-foreclosures in any market.

For example, in Houston, Texas, the foreclosure filter pulled up over 200 properties. You can then narrow results by price, square footage, location, or even keywords.

It’s a great starting point for investors who want a broad view of foreclosure inventory.

Read Also: Redfin Vs. Zillow In 2025: Estimates, Accuracy, & More

How To Find REO Properties: What to Look For

This type of property is different from what we’ve seen on HomePath or HUD Home Store. A traditional REO foreclosure often comes with more distress, and in many cases you cannot get financing on it.

For example, a property listed at $240,000 could make sense for the right investor, even if it requires more work. Personally, I like income-producing properties and flips, so deals like this are worth bookmarking and analyzing later.

All in all, Zillow foreclosures seem to offer plenty of opportunities for investors. The large amount of inventory signals possible distress in markets like Houston, but that can be good news for investors who believe in the long-term outlook.

As investors, we want to see inventory because it gives us options to negotiate and find great deals.

If your market doesn’t show much, expand your search radius into neighboring counties or cities. This way, you’ll start to see what foreclosure opportunities look like in your area or nearby.

Realtor.com Foreclosures and Deal Evaluation

Realtor.com also lets you filter directly for foreclosures, though many people don’t realize this. Let’s use Birmingham, Alabama, as an example to compare with the other sites.

After typing in the location, use the filters and select “foreclosures.” In Birmingham, 44 foreclosure homes appeared in the results—plenty of potential leads to evaluate.

One example is a five-bedroom, two-and-a-half-bath home listed at $152,000. At 4,300 square feet, that’s only $35 per square foot, which is extremely cheap. From the outside it looks decent, but once inside you notice exposed framing and signs of deferred maintenance.

This is common with foreclosures. Banks and lenders often winterize properties to prevent damage, which is why we see details like disconnected toilets. Since banks aren’t in the business of managing homes, they are motivated sellers looking to move these off their books.

For investors, that means great deals. A house like this could be ideal for a novice investor’s first project. It’s rough around the edges but relatively move-in ready. With some cosmetic updates, it could be turned into a strong rental or flip.

Another listing we saw looked like it may have been a previous flip project repossessed by the bank. The finishes were modern and updated, but the price history suggested lots of room for negotiation. Checking loan history and current debt can reveal flexibility in purchase price.

Overall, Realtor.com provides plenty of foreclosures that range from distressed homes to nearly turnkey properties. If you’re serious about buying, this platform is a valuable addition to your search.

Read Also: Wholesaling Pre Foreclosures

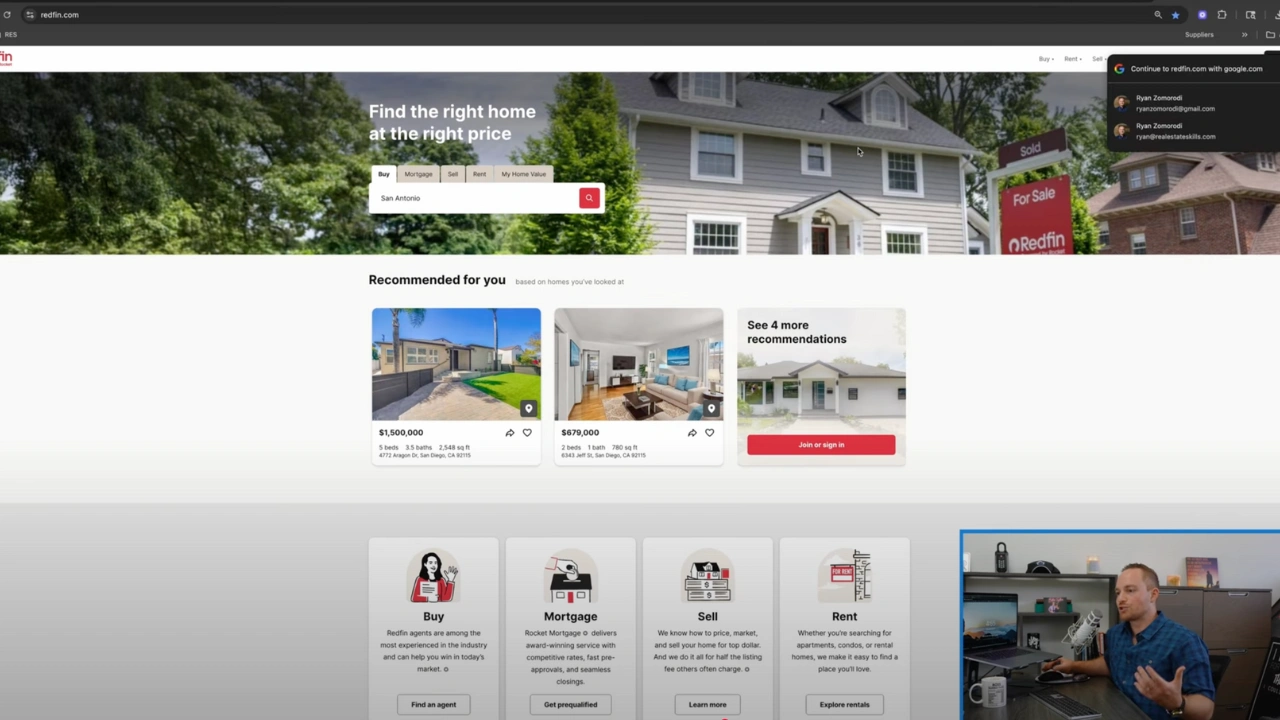

Using Redfin to Find Foreclosed Properties

Redfin is another great free option. Similar to Zillow, it lets you apply foreclosure filters and view listings directly on its platform.

You can see price history, days on market, and other data that helps in analyzing whether a deal makes sense.

The user-friendly interface and reliable data make Redfin a solid resource for foreclosure investors.

Understanding the Foreclosure Timeline

It’s important to understand how the foreclosure process works. The timeline usually starts with missed payments, followed by a notice of default, and eventually ends in auction or bank repossession.

Knowing this timeline helps you identify opportunities earlier in the process, which can sometimes mean less competition.

Analyzing Actual Foreclosure Listings

Let’s take a closer look at a few real foreclosure listings so you can see how to evaluate them as an investor.

For example, one property had an ARV (after-repair value) of around $220,000, but it needed about $40,000 in repairs. The asking price was $120,000. After factoring in closing costs, holding costs, and selling fees, this deal left about $30,000 in profit potential.

When reviewing listings, focus on three main things: the ARV, the estimated repair costs, and your purchase price. If those numbers leave enough margin for profit after expenses, you’ve likely found a solid deal.

Analyzing a Foreclosure with Our Deal Calculator

To make this easier, we use our own deal calculator to plug in the numbers.

Take a property listed at $185,000. If the ARV is $260,000 and repairs are estimated at $30,000, the calculator shows whether there’s enough margin to flip or wholesale it. By entering financing costs, closing costs, and profit goals, you’ll quickly see if the numbers work.

This tool takes the guesswork out of analyzing deals and helps you make offers confidently.

Multiple Exit Strategies: Flip vs Wholesale

One of the biggest advantages of foreclosure investing is flexibility. If the deal works as a flip, you can renovate and resell. But if you prefer faster returns, you can wholesale it to another investor for a fee.

Having multiple exit strategies reduces your risk. Even if your first plan doesn’t work out, you’ll have another way to profit from the deal.

Running Rental Numbers on a Foreclosure

Not every foreclosure has to be flipped. Many of these properties make excellent rentals, especially if they’re in strong rental markets.

Let’s say you pick up a foreclosure for $120,000 that needs $20,000 in repairs. With an all-in cost of $140,000, you could rent it out for $1,500 per month.

By running the numbers, you’ll see whether the property produces positive cash flow after accounting for taxes, insurance, and maintenance.

Rental Cash Flow Analysis Breakdown

Here’s how we break it down. Start with the gross rental income—$1,500 per month, or $18,000 per year. Subtract operating expenses like property taxes, insurance, property management, and maintenance. That might leave you with around $12,000 in net operating income.

If your all-in cost was $140,000, that’s about an 8.5% cap rate—solid for many markets. If you used financing, you’d also subtract your mortgage payment to calculate your true cash flow.

This analysis shows how foreclosure properties can work not only as flips but also as buy-and-hold rentals that generate long-term wealth.

Final Thoughts

By now, you know how to:

- Find free foreclosure deals on HUD, HomePath, Zillow, and Redfin

- Use Foreclosure.com for advanced deal flow

- Understand the foreclosure timeline

- Analyze numbers like a pro with my free deal calculator

- Apply multiple exit strategies to maximize profit

The truth is, most people stop at finding deals. But the real money comes from analyzing and executing them.

If you’re ready to take this seriously, download my free foreclosure deal calculator at realestateskills.com/calc, and start running the numbers yourself.

Because finding foreclosures is easy. Turning them into wealth—that’s where the real skill comes in.

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

*Disclosure: Real Estate Skills is not a law firm, and the information contained here does not constitute legal advice. You should consult with an attorney before making any legal conclusions. The information presented here is educational in nature. All investments involve risks, and the past performance of an investment, industry, sector, and/or market does not guarantee future returns or results. Investors are responsible for any investment decision they make. Such decisions should be based on an evaluation of their financial situation, investment objectives, risk tolerance, and liquidity needs.