Wholesaling Rental Properties: The Ultimate Guide

Oct 15, 2025

Investing in a rental property offers you the opportunity to earn monthly rental (or passive) income and the potential for appreciation during your ownership.

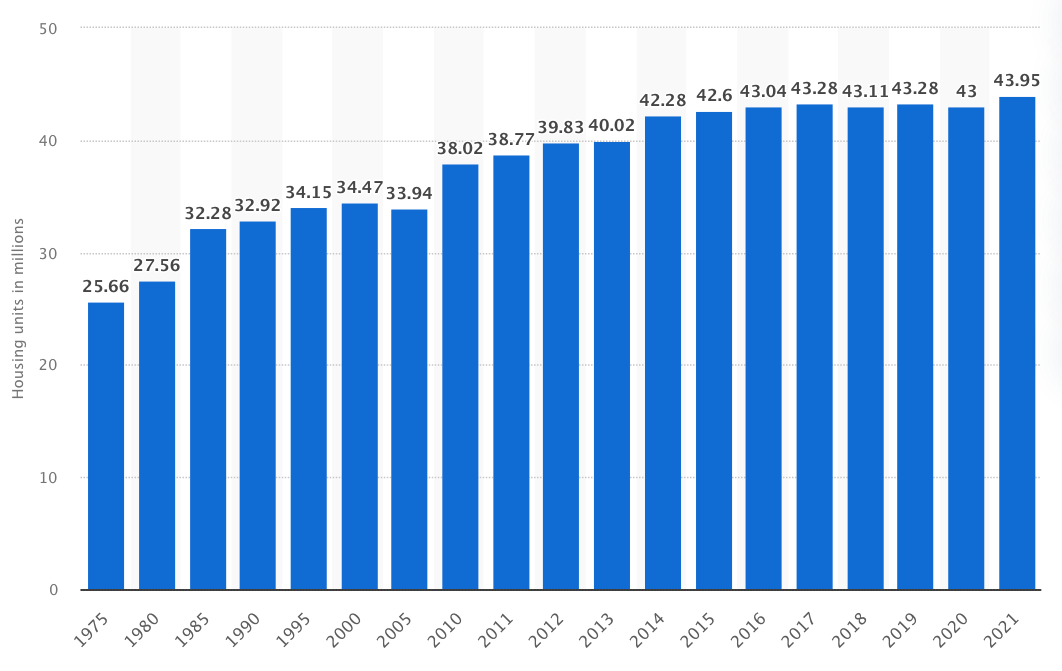

In the United States, in 2021, there were nearly 44 million renter-occupied housing units – comprising a massive sector of the real estate market and often on the radar of savvy real estate investors.

Wholesaling rental properties offer real estate wholesalers some tremendous opportunities to tap into this demand and turn a quick profit – especially in smaller properties.

- What Is Wholesaling?

- What Is Wholesaling Rental Properties?

- Can I Wholesale Rental Property?

- How To Wholesale Rental Properties: Step By Step

- Is Wholesaling Rental Properties Legal?

- Is Wholesaling Rental Property Worth It?

- Final Thoughts

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

What Is Wholesaling?

The art of wholesale real estate is a short-term real estate investment technique that offers many individuals an accessible entrance ramp into what is often a pricey real estate market.

Wholesaling’s objective is straightforward –

- Enter a contract to purchase a property priced below market value. A wholesaler can choose to work with single-family homes, rental properties, condos, or multi-family properties. Underpriced properties are typically characterized by a homeowner in financial trouble or the property being in disrepair.

- Exit the transaction by assigning (or transferring) their “right to purchase” or their “equitable interest” to another investor or another potential buyer from a curated buyers list. It is this buyer who ultimately closes on the home and becomes its owner. This final or end buyer will most likely be a cash buyer who intends to generate a profit by renovating the property that would attract a retail buyer.

One of the key benefits of real estate wholesaling is that this technique requires much less capital to get started. Usually, there is a small Earnest Money Deposit held in escrow. This investment strategy requires the wholesaler to find motivated sellers with an urgent need to sell. These scenarios include:

- An approaching foreclosure.

- Selling the property as a short sale.

- Property issues or neglect.

Pro-Tip - Wholesalers and house flippers have different objectives, so their techniques differ. Flippers intend to take possession of the property, at least temporarily – wholesalers typically DO NOT.

What Is Wholesaling Rental Properties?

A successful wholesaler may choose to specialize in rental properties. They simply find a non-owner-occupied property priced below market value that has a highly motivated seller.

However, wholesaling rental properties may be a bit more complex as there are legal matters and limitations (like existing lease agreements with current tenants) that do not apply to owner-occupied properties.

The end buyer of a rental property is typically interested in the stream of rental income that the property produces. The net operating income (NOI) is a key metric that influences the valuation of that piece of real estate.

What Is A Rental Property?

A rental property is defined as any property that is used or occupied by a tenant who pays rent to a landlord or property owner. The term residential rental property distinguishes itself from commercial properties where the tenant is a business or corporate entity, not an individual or a family.

People own rental properties as a source of income. The income generated by one or more tenants is used to pay down monthly mortgage obligations, plus taxes and other expenses. If the gross rent exceeds the level of expenses, the rental property generates an income. If the expenses exceed the rent, the rental property would be operating at a loss.

Read Also: How To Buy A Rental Property With No Money

The IRS Definition Of Rental Property

By IRS definition, a residential real estate property is one that generates more than 80%+ of its revenue from the dwelling. This specific definition impacts tax liabilities and allowable depreciation. The IRS Publication 527 Residential Rental Property provides a comprehensive overview of the tax rules and is updated as regulations are modified.

Can I Wholesale Rental Property?

The short answer is yes; you can wholesale rental properties. But, as a wholesaler, you must remain within the legal boundaries set forth by the relevant laws and regulations.

Note, however, that rental properties typically have ongoing lease agreements with their tenants - although not always as in a month-to-month lease. If the wholesale deal requires a closing that takes longer than a few days or weeks, this potential concern for wholesalers may be a non-issue.

However, if the wholesale deal goes off track, the legal limitations defined by an existing lease could make the transaction a bit more challenging and complex. That said, often buyers prefer to purchase rental properties with tenants that are paying rent. This way the investor may be able to create cash flow from the property on day one of ownership.

How To Wholesale Rental Properties: Step By Step

Step 1: Know The Regulations That Govern Your Real Estate Transaction

Wholesalers must recognize the state laws that regulate real estate transactions in the relevant jurisdiction. State law is often modified yearly, so it is essential to not only know the basics but also stay current with new legislation that may impact wholesaling real estate.

As a rule, state laws mandate an individual to earn a real estate license if they wish to market, sell, or list real property unless the principal owner is the person marketing or selling the property.

In other words, wholesalers CAN NOT legally market or sell real property – without obtaining the appropriate license per the terms set forth by the state authority.

Wholesaling A Rental Property Differs From Selling, Listing, Or Marketing Real Property.

Wholesalers sell or market a real intangible asset - their "right to buy" the property for a certain amount within a defined time.

Selling or marketing one’s right to buy a home IS NOT the same as selling real estate. This is a distinction WITH a difference.

A wholesaler’s “right to buy” a property is awarded when the purchase agreement is fully executed. The granted "right to buy" is known as equitable interest. As noted above, the marketable asset is awarded to a legally-bound buyer through the Principle of Equitable Conversion.

Pro-Tip - Wholesaling real estate is now governed by the law in the states of Illinois, Philadelphia, and Oklahoma.

Step 2: Know Your Market

Real estate, when viewed as one industry, is among the most significant economic drivers of the national and global economy because its many facets impact many industries and sectors – plumbers, realtors, electricians, mortgage professionals, lawyers, title companies, decorators, roofers, window makers – you get the picture.

Fortunately, government agencies (like the Bureau of Economic Analysis BEA), real estate agents, and market experts offer tremendous amounts of data, statistics, and insights to help define the current position of the overall and local real estate markets – all of which is available online, usually at no cost.

For beginners and those new to wholesaling or the rental market per se, it might be prudent to share your talents and objectives with someone more knowledgeable who can help guide you until you have a strong understanding of the wholesale rental property process.

In-depth market knowledge is vital to assessing the quality of an investment opportunity.

Step 3: Define Your Investment Benchmarks

The potential of a wholesale rental property deal should be evaluated before making the legal commitment dictated by a contract of sale or purchase agreement. Most wholesale rental property real estate deals focus on a simple analysis that is designed to assess the wholesale deal’s possible profit.

The profit for a rental or investment property wholesale deal is equal to the difference between the wholesaler’s initial contract price and the sales price that is agreed upon by the final or end buyer.

Rental property wholesalers follow the 70% Rule, a fundamental investment standard that is used to determine the viability of the potential profit. An example will help clarify this basic financial benchmark:

A wholesaler executes a purchase contract for single-family rental property for $170,000. The rental unit will require some renovation and updates. Their investment analysis determines that this rental property could be sold for $350,000 when the noted renovations have been completed.

The rental home’s anticipated sales price of $350,000 is known as the After Repair Value (ARV) – the expected or future value of the rental property.

Similarly, investors flipping houses, who often buy from wholesalers, use the 70% investment benchmark. The primary difference is that a real estate flipper intends to take possession of the rental property, whereas the wholesaler does not.

So, if the wholesaler and fix and flipper agree on the ARV, the maximum amount a flipper would be willing to pay would be 70% of the ARV or $245,000.

Analyzing The Potential Profit Of The Wholesale Rental Property Deal

The wholesaler, as a buyer, can buy the rental property for $170,000, which offers a return of $75,000, which is an attractive return for a short-term investment in real estate. Directly related to the ARV investment benchmark is another strategic technique – the Maximum Allowable Offer (MAO).

But there is one more layer of analysis.

The above-noted Maximum Allowable Offer (MAO) analysis must also include the expenses required to prepare the property for sale to a homebuyer rather than another real estate professional investor.

- Renovation and carrying costs.

- Closing fees if they apply.

Note that a real estate flipper’s Maximum Allowable Offer (MAO) will be reduced by those expenses required to finalize the rental property wholesale transaction.

In the above example, if the estimated costs to repair (and carry the property during construction) are $50,000, the Maximum Allowable Offer for a fix and flipper would be $195,000, which is simply the ARV minus the transaction’s expenses ($245,000 - $50,000 = $195,000).

If this rental property deal closes, as noted above, the wholesaler has the potential to earn $20,000 ($195,000 - $175,000).

Check out our quick video that shows how you can find cash buyers for free online!

Step 4: Search & Locate Property

Wholesaling rental properties begins with the right property. The modern business landscape offers many ways to access potential rental properties that may be suitable for wholesaling.

- Online websites dedicated to pre-foreclosures, foreclosures, and auctions.

- Podcasts dedicated to wholesaling houses and other real estate investments.

- Websites like Craigslist and other social media giants.

- Family & Probate Lawyers to Locate Off-Market Properties.

- Data resources.

- Local marketing or direct mail efforts.

Step 5: Negotiate And Execute The Contract

As a wholesaler, even with your actions within the letter of the law, you teeter mighty close to the legal line in the sand. Given the potential legal consequences, it pays big dividends to work with integrity and transparency – to avoid even the appearance of impropriety. This approach is a great way to build professional trust.

When a wholesaler finds a rental property that meets their established investment benchmarks, they execute a contract for the sale of the property at a specific price within a defined timeframe. A small Earnest Money Deposit (EMD) is held in escrow to show good faith.

Wholesalers who are new to the rental property market are advised to consult with a real estate lawyer if they are unfamiliar with the legal language or potential consequences for breaching a contract of sale.

Step 6: Exit The Deal

Investors of rental wholesale properties use these exit strategies –

Method 1: The Assignment of Contract

In the assignment exit strategy, the wholesaler executes a contract but never takes the title. Prior to closing, they assign equitable interest/title to another buyer at a higher price using an Assignment of Contract.

The profit would be defined by subtracting the second purchase price from the initial contract price.

Method 2: The Double Close

In the double close strategy, a wholesaler enters into a contract but takes the title. However, possession or title is temporary and may only be an hour or a day. Note this method incurs dual closing costs but increases your legal protection because you are the principal owner and need no license.

Is Wholesaling Rental Properties Legal?

Yes. Wholesaling real estate is legal if the wholesaler does not act or behave in a way that breaks the relevant state law.

Remember, as a rental property wholesaler, you are a middleman. You have one asset to market or sell – your right to buy a specific rental property at a predetermined price and time. The wholesaler’s equitable interest can be marketed and assigned to another buyer for a profit using ‘an assignment of sale.’

Most real estate contracts, by default, are assignable. However, if you are unfamiliar with this legal language, it is important to consult with a real estate attorney for additional guidance.

Read Also: Wholesale Real Estate Contract: The (Ultimate) Guide

Is Wholesaling Rental Property Worth It?

In many respects, the rental property sector of the real estate market is among the strongest. Its strength is in its numbers.

The National Association of REALTORS (NAR) anticipates that rental prices will outpace the rise in home prices – increasing more than 7% in 2022. Rising rental prices will ultimately increase the rental property’s potential Return on Investment – this directly influences the value of the property.

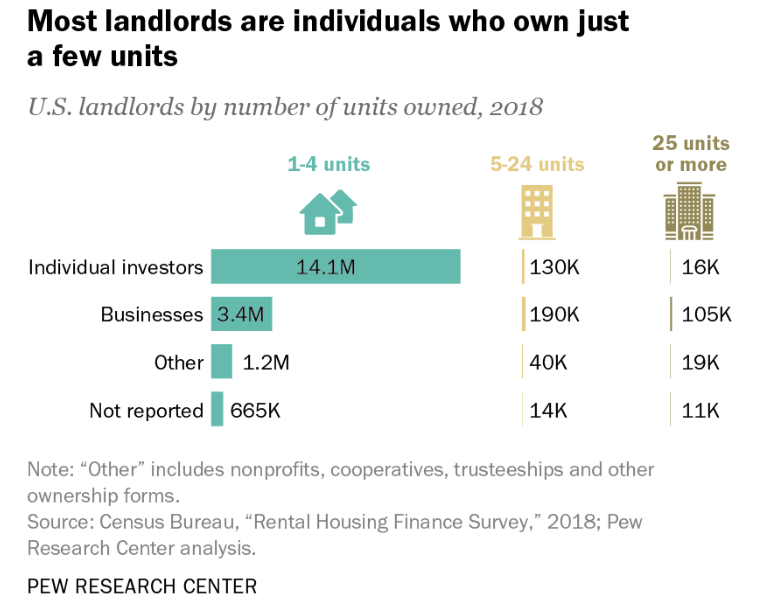

According to Pew Research Center, 72.5% of single-unit rental properties are owned by individuals. Nearly 70% of properties with 25+ units are owned by for-profit businesses.

Final Thoughts

A real estate wholesaler, like any other investor, has an objective to generate a profit. The rental property market is hot, with real estate experts anticipating rising rental costs for the foreseeable future.

To summarize, wholesaling rental properties -

- Requires minimal capital expenditures and does not require a significant down payment.

- Avoids the need to meet the requirements of mortgage lenders or hard money lenders.

- Offers a viable entrance ramp to the real estate industry as an investor.

- Must include appropriate analysis of the potential profit of any type of real estate that performs as a rental property.

- It may include a legal snag if the deal stalls and there are existing lease agreements with the current tenants that may impact your cash flow.

- Offers a shorter-term real estate investing strategy (thereby reducing risk) than that of fix and flipper investments.

If you’re serious about doing your first real estate deal, don’t waste time guessing what works. Our FREE Training walks you through how to consistently find deals, flip houses, and build passive income—without expensive marketing or trial and error.

This FREE Training gives you the same system our students use to start fast and scale smart. Watch it today—so you can stop wondering and start closing.

*Disclosure: Real Estate Skills is not a law firm, and the information contained here does not constitute legal advice. You should consult with an attorney before making any legal conclusions. The information presented here is educational in nature. All investments involve risks, and the past performance of an investment, industry, sector, and/or market does not guarantee future returns or results. Investors are responsible for any investment decision they make. Such decisions should be based on an evaluation of their financial situation, investment objectives, risk tolerance, and liquidity needs.